by : Lawrence Richter Quinn

The concept is so simple; so why

are so many people, including shareholders, having such a hard time getting

their heads around the phrase "operational risk" or "op

risk" - the risk of loss from any operational failure at a company?

Not only are they having a hard

time understanding it, the vast majority of stakeholders have never heard the

term - even though a great a great number of finance specialists say

extraordinarily poor management of operational risk (not other categories of

risk, such as market, liquidity or credit) is exactly what led to the collapse

of global financial markets starting in 2007. (Read about the financial crisis

that struck in 2007 in The 2007-08 Financial Crisis In Review.)

That is exactly why investors and

other stakeholders need to get up to snuff on operational risk as quickly as

possible. If they don't, there's every reason to expect other financial

implosions to follow.

The Impact Of Op Risk

What may surprise stakeholders is

that a number of financial experts say poor operational risk management has

been the underlying cause of every major financial services loss over the past

two decades - including this past year's $180 billion-plus bailout of American

Insurance Group (AIG) and well-publicized fiascoes such as those at Barings,

Long Term Capital Management (LTCM), Allied Irish Bank-All First, Societe

Generale, Bear Stearns and Lehman Brothers.

Even more surprisingly, the

finger pointing doesn't stop there. Any number of additional significant upsets

at "non-financial" companies - everything from Union Carbide's

chemical leak in Bhopal, India years ago to JetBlue's massive ticketing and

route scheduling failures to accounting-related fraud at Cendant and Bausch

& Lomb - can be attributed to operational risk management failures.

"Until investors and all

stakeholders - John Q. Taxpayer, corporate board members, 'C-suite' executives,

shareholder activists, ratings agencies, analysts, regulators, even legislators

- understand this risk and how to measure and manage it, there is no way to

guarantee that we won't face future financial meltdowns as big as, or bigger,

than the most recent one," says Ali Samad-Khan, founder and president of

Stamford Risk Analysts (a recent rebranding of OpRisk Advisory) in Connecticut.

"Coming to terms now with

operational risk must become a strategic imperative for organizations in all

industries, not simply for financial services giants."

Bolstering the view that stakeholders

must understand the importance of operational risk is a just-released study

from the Society of Actuaries, the Casualty Actuary Society and the Canadian

Institute of Actuaries called A New Approach for Managing Operational Risk:

Addressing the Issues Underlying the 2008 Global Financial Crisis.

"Regulators and other key

stakeholders (e.g., rating agencies) need to take an active role in calling for

improved ORM practices," the report notes. "Historically, ORM has

taken a back seat to the management of the other major risks, which are often

defined as market, credit, insurance and strategic risk and sometimes include

'liquidity,' 'legal' and 'reputation' risk … This has not only caused

operational risk to be underestimated, but has also obscured the underlying

causes of many of the most significant financial losses."

Just What is "Operational

risk"?

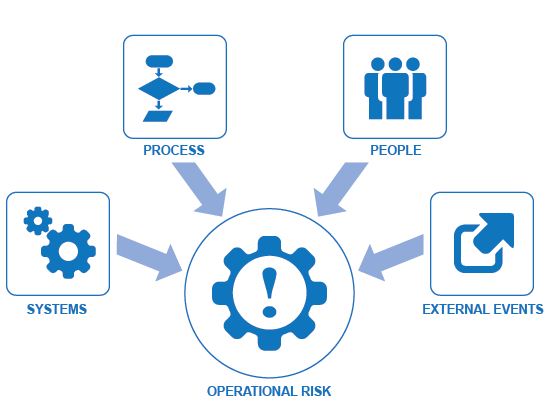

So how do we define operational

risk? On its face, it sounds enormously simple: the risk of financial loss from

any operational failure. But "operational failure" encompasses a

dizzying array of possible events, actions and inactions - everything from

inadvertent execution errors, system failures and acts of nature to conscious

violations of policy, law and regulation. Of course, it also encompasses the

greatest of all faux pas: direct and indirect acts of excessive risk-taking.

It's exactly this depth and

breadth of issues and "cross-silo" concerns that has lead to ongoing

confusion about exactly what is and isn't an operational risk - and continuing

doubts about how to identify and manage it. For instance, too often op risk has

been misdiagnosed as other, relatively newer areas of recognized exposures such

as those involving IT security, supply chain and business interruptions.

As a result, some corporate managers

argue that op risk simply doesn't exist - that it is nothing more than existing

risks by a newly-invented name - or that, if in fact it is a legitimate,

separate exposure, the amount of operational risk they face isn't significant

enough to merit a specific and separate measurement and management system.

Typically, executives at non-financial organizations advance these views -

pointing out, for instance, that they don't run complex trading operations or

have the related balance sheet concerns faced daily by the world's banking,

energy and commodity firms.

Finally, that op risk has been

recognized formally by the regulatory community as a legitimate issue only

recently (and then, by financial services regulators exclusively), hasn't

helped encourage active recognition or management of it. That acknowledgment

came in 1999, when the Basel Committee on Banking Supervision, a global

financial services firm, highlighted operational risks as a distinct potential

bête noire..

Much Ado About Nothing?

Many stakeholders might view

discussions about whether op risk exists, what it is, how it differs from other

exposures, and if and how it can be managed as academic. It's easy to dismiss

the debate thinking that, whatever its merit, it has no bearing ultimately on shareholder

value, reputation, governance or related concerns.

But op risk proponents say it's

not so. Those who don't acknowledge their own op risks are simply setting

themselves up for future devastating material failures and losses.

Indeed, they say, the seeming

minutiae of operational issues can quickly spin out of control into a major

balance sheet and stakeholder concern. One example comes from Norm Parkerson,

executive director of advisory services at Grant Thornton in Atlanta, who

points to a recent unanticipated op risk loss suffered by one of his own

clients. In this case, a manufacturing company introduced a new product covered

by a warranty reserve based on its own historical data. Unexpectedly, a

manufacturing problem - an operationally-related risk - generated warranty

claims far exceeding the warranty reserve booked on its balance sheet. The

result: a loss of well over $100 million.

"This happened rapidly and

the impact was far reaching," says Parkerson. "Not only was there an

impact to the financial statement; there was an adverse impact on the

manufacturing process, the quality assurance process, the procurement of raw

materials, the ability or inability to fulfill customer orders, and the

company's reputation."

Managing Op Risk

Unfortunately for stakeholders,

no models exist where they can turn to management and boards and ask: "How

effectively are you managing op risk - for instance, against X, Y or Z?"

In fact, banks and insurers

acknowledge that they don't know if their op risk management endeavors to date

have been successful.

The SOA's report says "Many

financial firms have spent millions of dollars hoping to improve their

management of operational risk, but those initiatives do not appear to have

achieved their desired objectives. Developing an effective method of managing

operational risk is proving to be a daunting task."

Meanwhile, stakeholders remain

far more exposed than they realize.

"Organizations that choose

to remain blissfully ignorant of the importance of operational risk will continue

to operate under a false sense of security," says Samad-Khan. "They

will remain 'under-controlled' in areas where they have the most risk and

significantly 'over-controlled' in areas where they have the least risk. So

without addressing op risk head on, recognizing and understanding it and

acknowledging the crucial role it plays, we face the prospect another global

financial crisis in the not too distant future."

The Bottom Line

Operational risk remains a controversial topic, but by whatever name you call it, the risk will not dissipate by being ignored. While managing op risk may be a daunting task, it is one of utmost importance to companies and shareholders alike.